Financial Outlook 1st Quarter 2019

In 2018 we went from the expansive to the recessive stage in the credit cycle. Stocks of the world capped, starting with the most exposed countries and concluding with the American stock market reaching a new artificial maximum in September. Artificial because it was the result of billions of dollars in buybacks and the vertiginous advance of a few species headed by the FAANG.

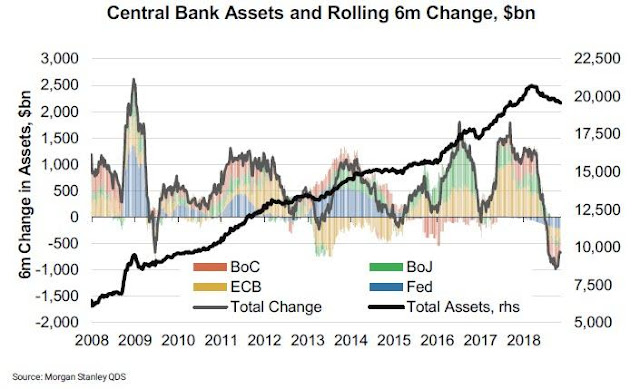

What to expect for 2019? Nothing good. The world continues with a record global leverage compared to its GDP, the credit bubble in China continues to expand as well as the housing bubble that includes countries such as Canada and Australia. All this accompanied by a decreasing liquidity resulting from the monetary policies of the FED and the ECB.

The underlying reality remains that most of the assets, with the exception of commodities, are still at record levels considering the slowdown scenario of the global economy. In the short term we will witness the bankruptcies and mergers of those who have been performing poorly. In the medium term, those who could not prepare for a shock in the structure of relative prices will follow. At this point, some type of intervention by the central banks is expected, which supposes a more intense shock in the price structure, generating probably inflationary pressure.

The most difficult variable to evaluate in this scenario is the political response of a fractured West in a more divided and less peaceful world. The turn towards this multipolar world has generated friction on many fronts, and the interaction between actors facing increasing domestic political pressure may be the source of new problems. 2019 may show us an even uglier face than of that of 2018. Risk exists, and by dint of optimism and interventionism has been ignored for more than 10 years.

The recommendations for 2019 first quarter are:

What to expect for 2019? Nothing good. The world continues with a record global leverage compared to its GDP, the credit bubble in China continues to expand as well as the housing bubble that includes countries such as Canada and Australia. All this accompanied by a decreasing liquidity resulting from the monetary policies of the FED and the ECB.

The underlying reality remains that most of the assets, with the exception of commodities, are still at record levels considering the slowdown scenario of the global economy. In the short term we will witness the bankruptcies and mergers of those who have been performing poorly. In the medium term, those who could not prepare for a shock in the structure of relative prices will follow. At this point, some type of intervention by the central banks is expected, which supposes a more intense shock in the price structure, generating probably inflationary pressure.

The most difficult variable to evaluate in this scenario is the political response of a fractured West in a more divided and less peaceful world. The turn towards this multipolar world has generated friction on many fronts, and the interaction between actors facing increasing domestic political pressure may be the source of new problems. 2019 may show us an even uglier face than of that of 2018. Risk exists, and by dint of optimism and interventionism has been ignored for more than 10 years.

The recommendations for 2019 first quarter are:

- Metals: maintain or increase exposure to precious metals or mining companies. Metals are cheap, and from every point of view below their natural value. Be careful, it should be remembered that the last crisis, of a deflationary nature, produced a 30% drop in gold before the explosive move up helped by the QE.

- US Stocks: eliminate exposure or short Nasdaq (or individual companies). The correction in the US indexes is being led by the small caps and the technological sector, as it was the recovery years ago. For those who like to bet down, there’s still good risk-opportunity to go short.

- Fiat Money: American Dollar. The true refuge seems to be the dollar. In spite of the de-dollarization plans of Russia, China and in a future Europe, rates hikes by the FED continue to generate upward pressure.

Comentarios

Publicar un comentario