Financial Outlook December 2018

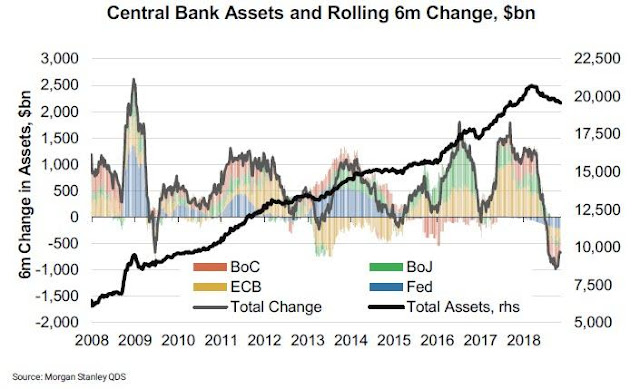

Following and expanding the note of 29/11: LinkedIn (Only in spanish) There are many narratives circulating in the media regarding the current weakness of the markets (Trade war, Brexit, China, Fed rates hikes...), but what is undermining the structure of the markets is the rotation of the expansive stage towards the recession stage in the credit cycle. How do we get here? Through the coordinated response aimed at overcoming the deflationary crisis that broke out in 2009 after the collapse of the housing bubble in the United States (result of measures aimed at overcoming previous crises). These measures, executed by the main central banks, and known as QE (Quantitative Easing), basically consist of lowering the rates to 0 and issuing abundant amounts of money. Brief formula for the creation of financial bubbles: 1- Keep interest rates low for a long time 2- Ensure abundant liquidity and credit facility 3- Encourage bad practices by allowing exces