Financial Outlook December 2018

Following and expanding the note of 29/11: LinkedIn (Only in spanish)

There are many narratives circulating in the media regarding the current weakness of the markets (Trade war, Brexit, China, Fed rates hikes...), but what is undermining the structure of the markets is the rotation of the expansive stage towards the recession stage in the credit cycle.

How do we get here?

Through the coordinated response aimed at overcoming the deflationary crisis that broke out in 2009 after the collapse of the housing bubble in the United States (result of measures aimed at overcoming previous crises).

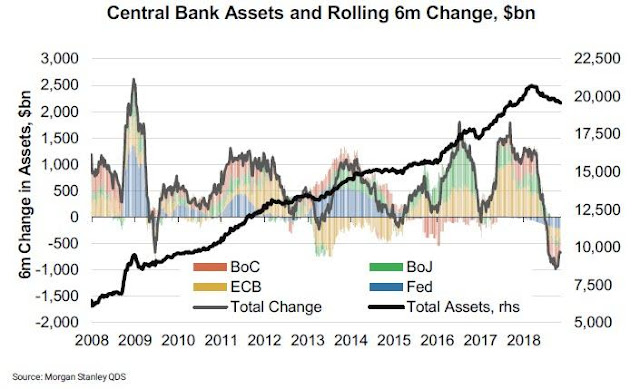

These measures, executed by the main central banks, and known as QE (Quantitative Easing), basically consist of lowering the rates to 0 and issuing abundant amounts of money.

Brief formula for the creation of financial bubbles:

1- Keep interest rates low for a long time

2- Ensure abundant liquidity and credit facility

3- Encourage bad practices by allowing excessive leverage and lax credit

4- Allow the creation of derivatives, leveraged derivatives and derivative derivatives.

During credit expansion, most financial institutions, pension and savings funds abandon the most conservative and defensive instruments, preferring riskier assets in search of better returns. When the cycle ends, all these institutions and funds are exposed to systemic risk through uncollectible debts and leverage in insolvent instruments.

Now we are in the part of the cycle where defaults and downgrades start to appear with increasing frequency. We can trace the ending of the cycle starting with the most exposed sectors, emerging countries (EEM) at the beginning of the year, followed closely by corporate high yield bonds (HYG - JNK), and this week with the Dow Jones Transport (DJT) and the Russell 2000 (RUT) reaching new lows. This without counting all the trend lines that were broken, some that started at the 2009 lows like the Russell 2000, Nasdaq 100 and S&P 500.

Maybe the trigger was the FED hikes accompanied by a world with more defined borders. The truth is that, accompanied by a decrease in the coordinated intervention of the central banks, the constant flow of available liquidity decreased, and with very little delay the markets reacted. At this moment, investors are confusing liquidity problems with volatility, and central planners are confusing solvency problems with liquidity problems.

With signs of exhaustion in the debt market, evidence of peaking in the economic cycle, very poor technical figures for all markets, and a S&P500/PE ratio well above the average, most of the financial assets seem expensive.

Portfolio composition: These are not recommendations of purchase or sale but the frame of reference on which to apply TA or Valuation techniques. All positions must have a Stop Loss and an exit strategy. If you do not understand these concepts, contact a financial advisor.

Bonds: Reduce or eliminate exposure

Today it is not safe or advisable to have bonds, although from the intermarket point of view there is a strong argument in favor of flight to quality. The mistake is to think that certain bonds are risk free.

Real State: Reduce or eliminate exposure

A large number of cities are entering what UBS calls “Real State Bubble risk”, which is a recommendation to stay away from real estate investments, especially when taking into account the 50 million vacant homes in China, a pin too large and to visible for the potential real state bubble.

Metals: Maintain or increase exposure to precious metals or mining companies

Metals are cheap, and under all points of view below their natural value. However, it should be remembered that the last crisis, of a deflationary nature, produced a 30% drop in gold before the explosive move up helped by the QE.

US Stocks: Eliminate exposure or short Nasdaq (or individual companies)

The correction in the US indexes, as well as the recovery years ago, is being led by the small caps, and technological sector. For those who like to bet down, there’s a good risk-opportunity to go short.

Fiat Money: American Dollar

The true refuge seems to be the dollar. In spite of the de-dollarization plans of Russia, China and in a future Europe, rates hikes by the FED continues to generate upward pressure.

Note: Many of the short-term factors could temporarily alleviate markets, however we must not lose sight of the fact that the underlying issue is the time bomb of global debt. Credit cycle is reaching an impending liquidation stage.

Comentarios

Publicar un comentario