Financial Outlook 1st Quarter 2019

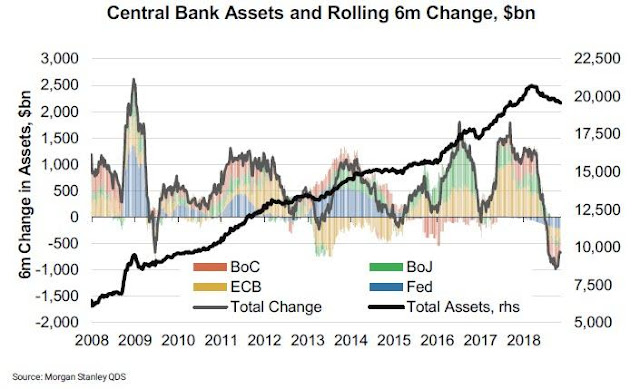

In 2018 we went from the expansive to the recessive stage in the credit cycle. Stocks of the world capped, starting with the most exposed countries and concluding with the American stock market reaching a new artificial maximum in September. Artificial because it was the result of billions of dollars in buybacks and the vertiginous advance of a few species headed by the FAANG. What to expect for 2019? Nothing good. The world continues with a record global leverage compared to its GDP, the credit bubble in China continues to expand as well as the housing bubble that includes countries such as Canada and Australia. All this accompanied by a decreasing liquidity resulting from the monetary policies of the FED and the ECB. The underlying reality remains that most of the assets, with the exception of commodities, are still at record levels considering the slowdown scenario of the global economy. In the short term we will witness the bankruptcies and mergers of those who have been performin...